7.2 Market Trends

This chapter describes the immunoassay market, primarily focused on the clinical sector.

Abstract

The status, value and rate of growth of immunoassay as a sector and the global in vitro diagnostic market as a whole are reviewed. Established trends are presented first as a response to market drivers and then as a result of advances in technology. There are overviews of assay formats, signal systems, automation, in vivo monitoring, molecular diagnostics, point-of-care, home testing, multiplex testing and new analytes. The current position of immunoassay on the marketing S-curve is evaluated. Finally, future drivers and trends are assessed, including the possible impact of new technologies and analytes.

2014 Update by David Huckle

In assessing the market position of immunoassay diagnostics in 2014 it is worth taking a short history lesson. In the 1970/1980s the established diagnostics were largely chemical methods with some of these tests better carried out by the emerging ligand binding technology, notably the high volume thyroid tests. The new technology evolved into immunoassay testing and grew rapidly once it became possible to replace the assay label with a non-radioactive marker. Not only did this allow the rapid replacement of chemical tests for low concentration analytes but also the technology opened up the possibility of testing for many analytes not accessible before.

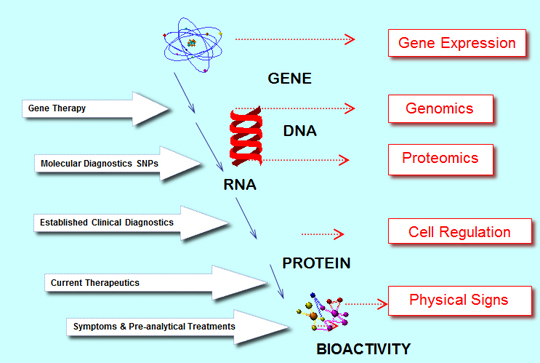

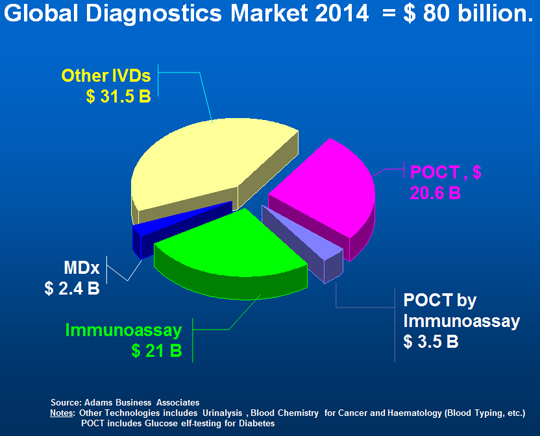

In subsequent decades the immunoassay market grew to become the major part of in vitro diagnostics (IVD) but the “Blood Chemistries” remained an important part of the total market and continue to do so today. The analogy for immunoassay as today’s major established diagnostic technology is the impact from molecular diagnostics (MDx). The technology of DNA analysis has been evolving for many years but it too has relied on the emergence of PCR technology for it to advance significantly, with further impact foreseen from Next Generation Sequencing (NGS). The analogy can go further with a big impact on infectious disease and cancer testing, where immunoassay has been strong but more importantly the MDx technology provides access to totally new clinical information with the importance of genetic information. All of this is an understandable evolution when seen alongside the biological cascade for life sciences below, Figure 1.

Figure 1. Biological Cascade for Life Sciences.

Source: Adams Business Associates.

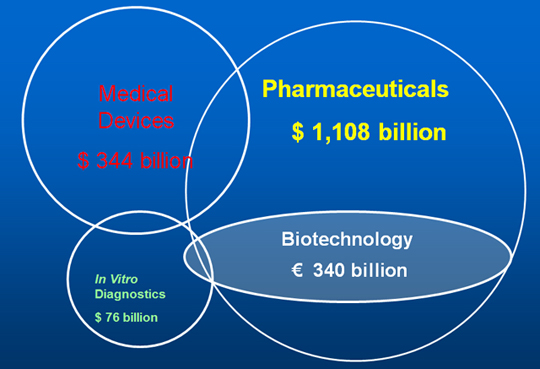

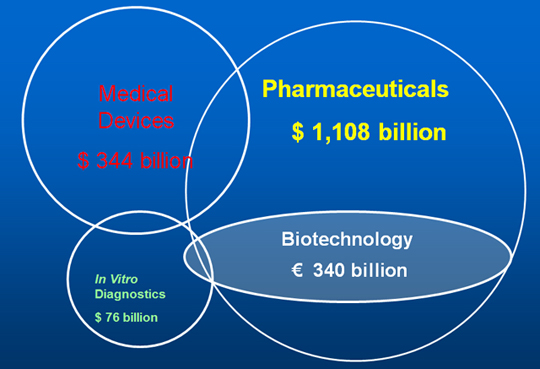

It is also important to view the position of the diagnostics product category in the provision of total healthcare at a time when there is a focus on reducing costs, particularly for pharmaceuticals, as in Figure 2. Here the role of diagnostics is seen to be of increasing importance to help define the patients that will most effectively respond to the specific drug. Although there is a strong push for this to come from MDx tests the molecular research might well identify specific protein biomarkers that can be more economically detected by immunoassay tests.

Figure 2. Diagnostics In Healthcare Markets, 2013.

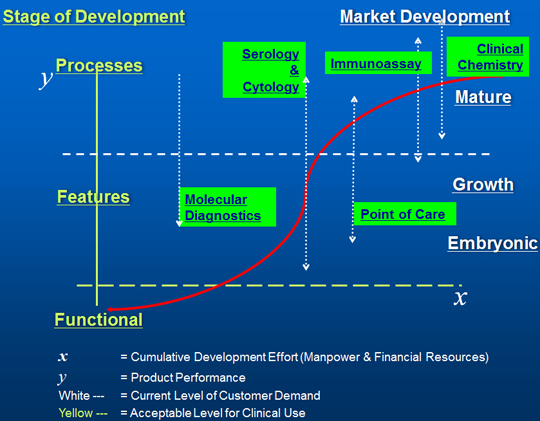

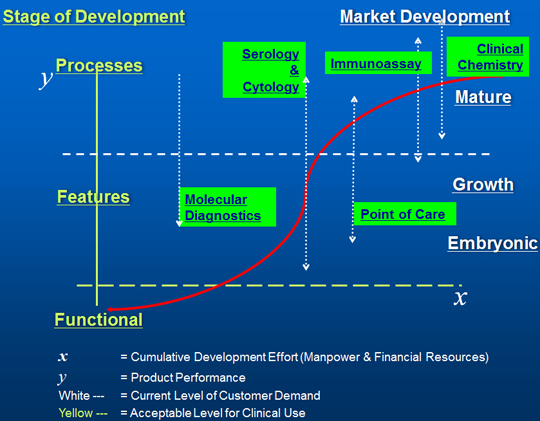

In closer analysis of the immunoassay market it has to be recognized that the technology has now become largely mature, although the market continues to grow steadily with expansion in emerging markets, Point-of-Care Testing (POCT), new analytes and new clinical fields. In order to realistically assess the current and future market for Immunoassay testing this technology development position has to be considered alongside other technology used in IVD testing, as in Figure 3.

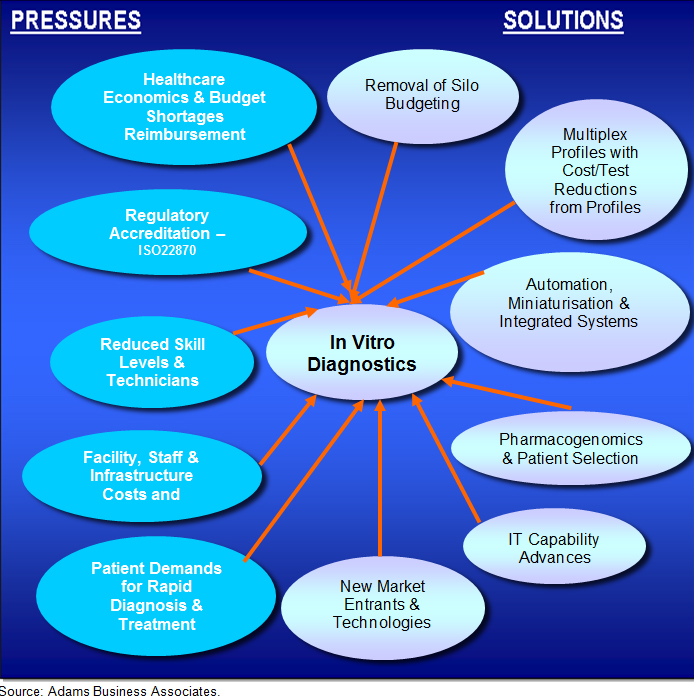

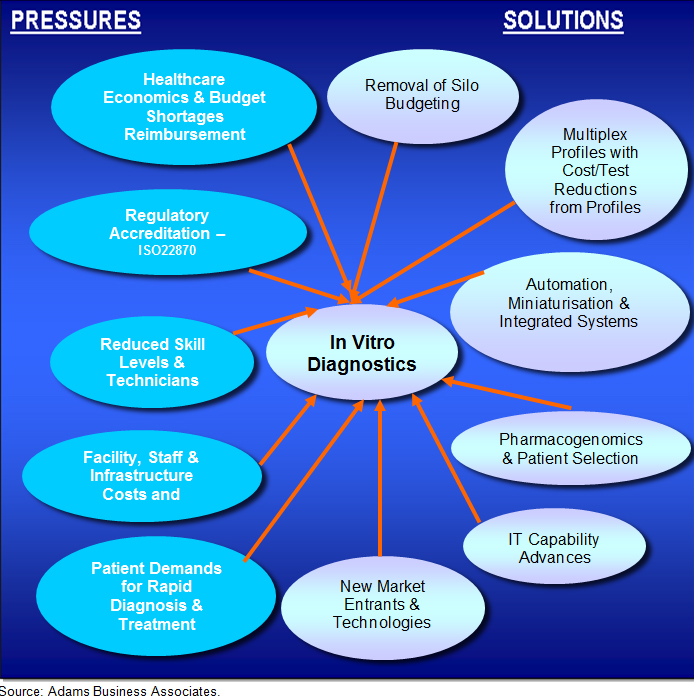

How the various technology options respond to the environmental pressures, as shown in Figure 4, is another feature that has to be taken into account for development of the overall IVD market as well as the specific Immunoassay market itself.

Figure 3. Technology S-Curve for the IVD Sector in 2014.

Source: Adams Business Associates.

An additional hurdle to be overcome is acceptance onto appropriate Reimbursement Schedules for laboratory-based tests in most European countries, matched by comparable schemes in Japan and the USA. The main exception is the UK where any approved product can be used. The analysis is free to the patient at the point of delivery but the hospital or laboratory in the public sector has to work within its allocated budget. Governments are now using the reimbursement process as a tool to reduce budgets by arbitrary reductions.

Regulatory requirements, which vary between Europe, the US (FDA) and Japan (MHLW), continue to represent a barrier to new entrants. Many countries moderate market prices through reimbursement systems with USA, Germany and Japan using this effectively as a tool to reduce costs in the last few years. Furthermore, in practice any international diagnostic company will have to operate good manufacturing practice (GMP) and a quality management system (QMS) that will satisfy FDA, MHLW or EU legislation.

Figure 4. Healthcare Pressures & Impact on Diagnostic Testing, 2014.

Source: Adams Business Associates.

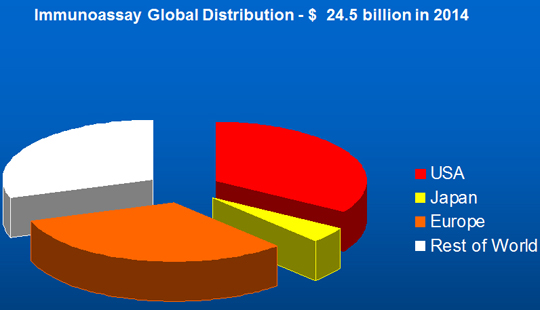

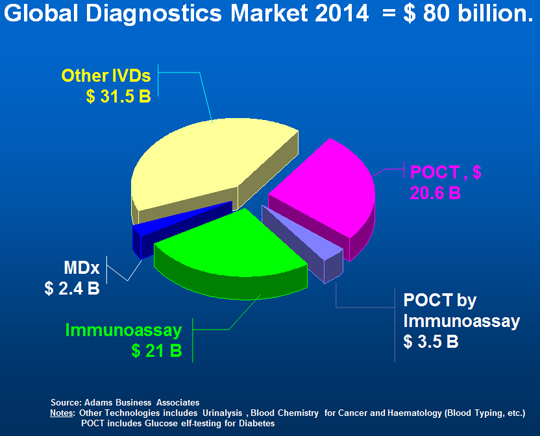

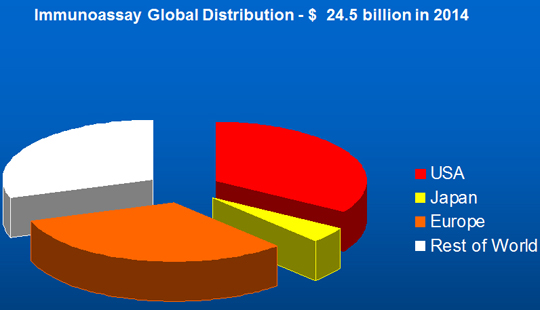

Out of all these aspects the global diagnostics market in 2014 was in total $80 billion (growth of 5.3%), including glucose (diabetes) testing, with immunoassay at $24.5 billion (30.5%, with 6-7% cagr.), Figure 5. The figure is of interest as it also identifies the immunoassay market that is used in the POCT segment. It is worth noting that the previous double figure growth for both POCT and MDx tests has slowed to high single digit figures with immunoassay steady at 6.5% overall.

The non-clinical figures for Drug Development are not included in the market figures and the bulk of IVD products have shown only slow growth in recent years, partly because of an artificial impact from those countries that have unilaterally lowered reimbursement.

Figure 5. Overview of IVD Diagnostic Testing Markets, 2014.

Source: Adams Business Associates.

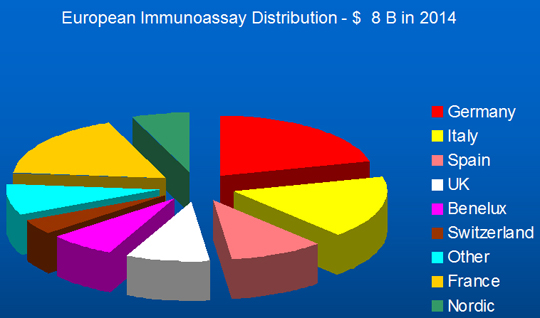

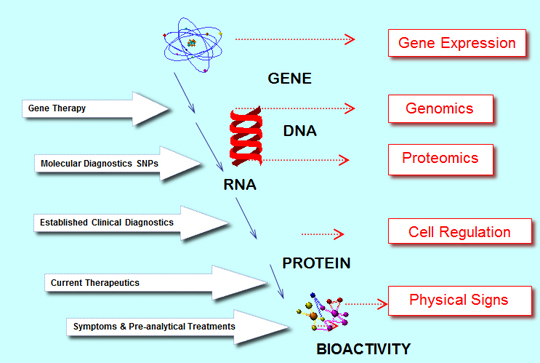

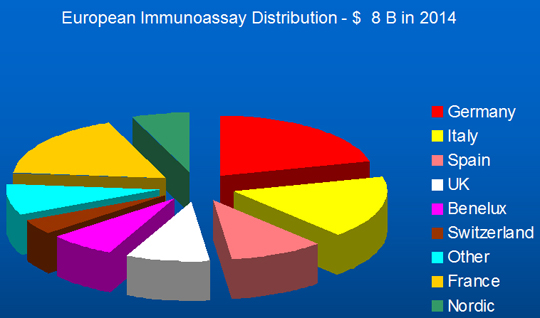

The growth figures for all technologies are lower than those seen in the Far East, mainly China and India but other markets also. The global immunoassay market by region in 2014 is shown in Figure 6, with the European distribution shown in Figure 7.

Figure 6. Regional Distribution of Immunoassay Market, 2014.

Source: Adams Business Associates.

Figure 7. European Regional Distribution of Immunoassay Market, 2014.

Source: Adams Business Associates.

All figures are used by kind permission of Adams Business Associates.

Useful Links

Please see the ABA web site for separate market reports on Global MDx and POCT at

www.aba-business.comContributor

Dr. David Huckle is Chief Executive of Adams Business Associates (ABA), set up in 1987 to provide business development and strategic marketing support in diagnostics, biotechnology and life science. He has over 20 years’ experience in pharmaceutical and diagnostics development and marketing, which gives a sound basis for analysis of global changes in these industries. Author of reviews and papers on diagnostics, point-of-care testing and implementation challenges for diagnostics, this practical experience has led to chairing several diagnostic conferences. He has developed a multi-volume Global Library of Life Science & Biotechnology, analyzing activities, funding and research, was a member of UKTI advisory group (BPSAG) covering Biotechnology/Pharmaceuticals and is launching an internet accessible directory of BioResource facilities in the UK. Key activities are now focused on Health Technology Assessment in a UK Health Economic Forum (MATCH partnership), for the NHS (National Innovation Centre) and development of economic models for NHS access for Medical Devices.

Keywords

Immunoassay, market, in vitro diagnostics, molecular diagnostics, cost containment, cost reduction, reimbursement, disease-related groups, health technology assessment, regulation, laboratory-developed tests, reference laboratory, nanotechnology, competitive immunoassay, immunometric, signal generation, signal detection, S-curve, functional phase, embryonic phase, feature phase, early growth phase, process phase, clinical sensitivity, clinical specificity, patient, biosensor, flow cytometry, personalized medicine, biomarker, homogeneous immunoassay, automation, test menu, analyte, multiplex, near-patient, home testing, point-of-care, lateral flow.